- Precious metal commodities historically have traded in narrow ranges over the short-term horizon

- Tail risk related to demand and supply shocks much less common than equities

- Attractive setup for algorithms trading on observed intraday patterns

- Precious metals are traded in USD, no FX exposure related to currency conversions

- Less exposed to event risks with no company specific SEC filings/earnings release creating volatility

- High correlation with fundamental factors driving commodity prices

- e.g. Silver has high correlation* with USD and US real-yields (inflation adjusted interest rates)

- Historically Diversifying: low/near-zero correlations to traditional equity and bond indices

- With equities under stress, and with bonds offering negative real yields in USD becoming less attractive as a source of income, this non-correlation may be even more important

- No risk to leadership transition/mismanagement (think Tesla!)

- Deep liquidity in US listed ETFs

- All holdings are level 1

- Prices in line with ETF NAVs

- Act as a natural hedge during periods of macroeconomic uncertainty

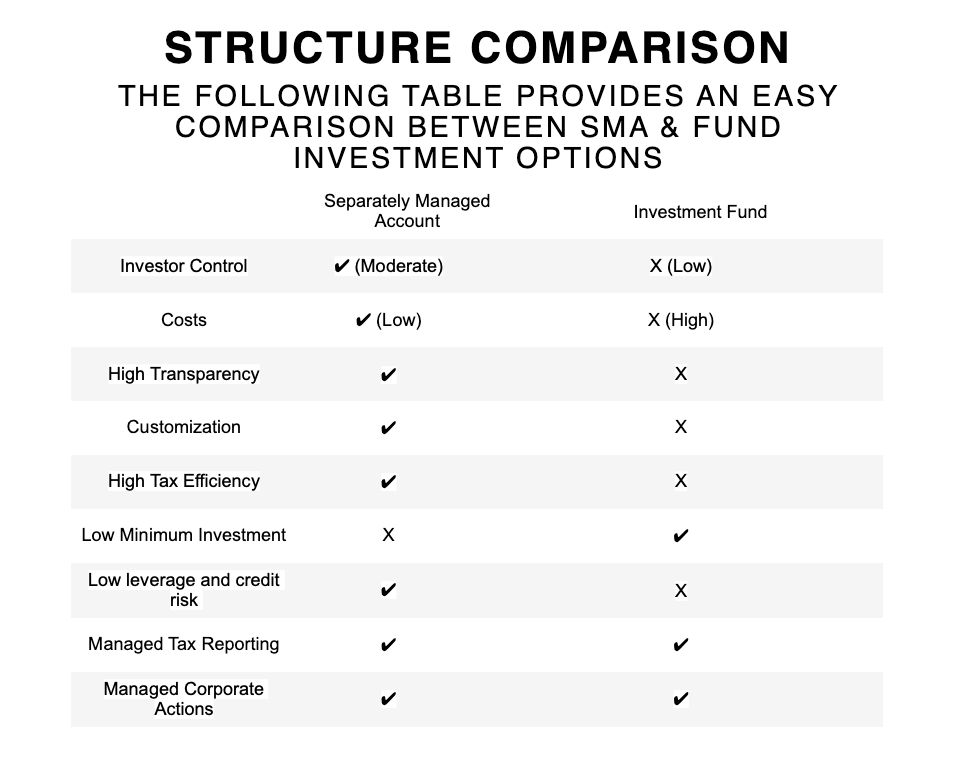

Invest in commodities via our Multi Strategy – Separately Managed Account